Each year our investment team does an in-depth analysis of our impact investing portfolio to get a better understanding of the social and environmental returns on our investments, as well as the traditional financial returns. We recently did a presentation with our board and staff to share highlights from the analysis. Here, we present a few takeaways.

Below, we show how our investing has changed over time. In 2013, McKnight decided to begin impact investing and committed to investing more of our endowment in strategies that aligned with McKnight’s mission. Today $1 out of every $3 reflects McKnight’s institutional values!

2013 Q4

$2,000,000,000

2018 Q4

$2,300,000,000

![]() Endowment

Endowment

![]() Impact Investing

Impact Investing

![]() Mission Aligned

Mission Aligned

Highlights

Our analysis was of the year prior, so highlights focus on 2017.

Sustainability Focus, Extraordinary Performance

In 2017, Generation’s Global Equity Fund graduated from the impact portfolio to the main $2.2 billion endowment.

Essentially, we auditioned Generation with a $25 million impact investment in 2014, and because of its great performance we invested $75 million more in 2017. Today it is worth more than $125 million, proving that our impact investing program can yield financial returns that are as satisfying as the social and environmental returns.

Sustainable Solutions

Anuvia, one of the portfolio companies in TPG’s Alternative and Renewable Technology fund, teamed up with Smithfield Foods, the world’s largest pork processor and hog producer, to convert Smithfield’s hog manure into fertilizer. That fertilizer is then used by farmers growing the grains that the hogs eat.

“Our process is a prototype for a circular economy, as we reclaim organic waste, convert it, and reuse it on cropland,” says Amy Yoder, Anuvia Plant Nutrients CEO. “This relationship provides a new sustainable way for Smithfield to return its remnant solids back to the land for use on the crops grown to feed the hogs.”

Due to better industrial processes, Anuvia uses 30% less energy to make its product than the conventional equivalent requires. Anuvia’s product is also better for the environment, reducing nitrogen runoff and groundwater leaching by 50%, which is a goal of our Mississippi River grantmaking program.

Blue-Collar Green

US solar leasing companies often want to work on big roofs for people with ultra-prime credit. PosiGen is an exception. Its customers are homeowners with low to moderate income. By combining affordable solar panel leases with energy efficiency makeovers, PosiGen helps customers in Louisiana, Connecticut, and New Jersey save on monthly utility bills while generating clean power.

Here are some examples of Posigen’s impacts:

Renewable Energy Generation

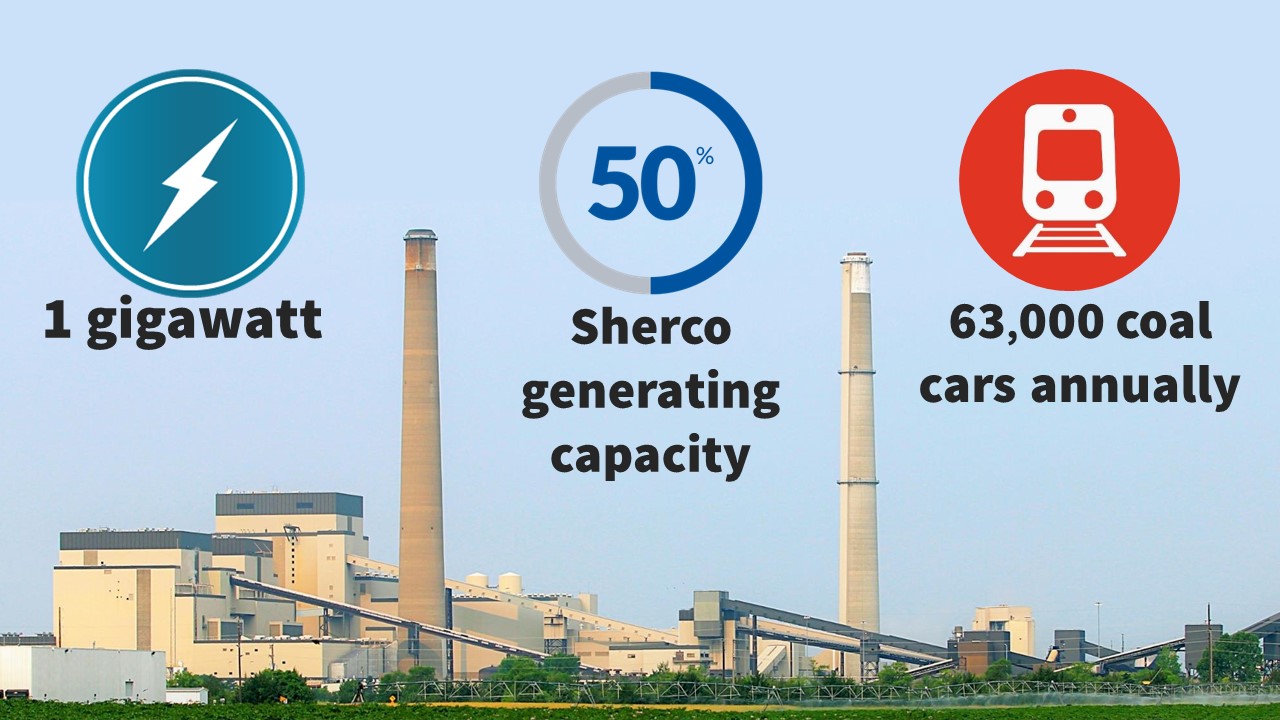

McKnight’s investments helped fund renewable energy installations from small rooftops to solar gardens to utility-scale development. In 2017, McKnight’s investment managers financed over 1 gigawatt of renewable energy capacity.

Since most of us have no idea how big a gigawatt is, here’s one way to conceptualize the impact. Minnesota’s largest coal facility—the Sherco plant in Becker, Minnesota—has the capacity to generate 2.2 gigawatts. Each day three coal trains, with 115 cars full of coal, arrive at Sherco from Wyoming. That means a gigawatt of clean energy is equivalent to 63,000 coal cars.

Growing Our Local Impact

McKnight is a place-based foundation with an emphasis on our communities. In 2017 our PRI and investment portfolio supported or preserved 1,423 units of affordable housing—both single-family homes and in apartment buildings. McKnight money also supported business loan funds that made loans to 77 businesses—from northern Minnesota to Appalachia—that diversify and strengthen local economies.

These highlights show that McKnight’s portfolio is generating the kinds of social and environmental returns that we had envisioned when we embarked on our impact investing journey back in 2013. As McKnight advances our commitment to using our role as an institutional investor for mission impact, this analysis shows us we are moving in the right direction.